Jewish Budgeting from Scratch – Free Printable

When we started being careful with our finances, I searched for a long time for a Jewish budgeting strategy or template to work off of. I wanted one that would specifically work for a frum family- including Shabbos and Yom Tov costs, tuition, Chanukah gifts and the like. And I couldn’t find one. I still haven’t been able to find one, so I decided to make one and share it with you. Disclosure: this post contains affiliate links.

Along with sharing the free printable, I thought I’d also share with you some tips I’ve learned along the way. Let me set the record straight. I’m not an expert. I’m not a professional in any sort of capacity so take any advice I might throw your way with a grain of salt. Always do what works for you and your family. There are months that we are in the red, and our budgeting principles failed us. We are human, and we are only trying our best, but there are some things that I wished someone had told us along the way, so I’m here to tell you what we’ve learned.

When my husband and I chose to take charge of our finances, it was hard to decide where to start. Like you, we scoured the internet for tips and ideas. We came across some terrific advice and some very terrible advice.

But, one thing that we did right was start from scratch. What that meant for us was completely starting over. We literally started a new month with the assumption of us not knowing anything about our own bank accounts and wallets and started tracking our spending. It took nearly six months for us to get an accurate portrayal of our finances. We tracked every dollar and every expense.

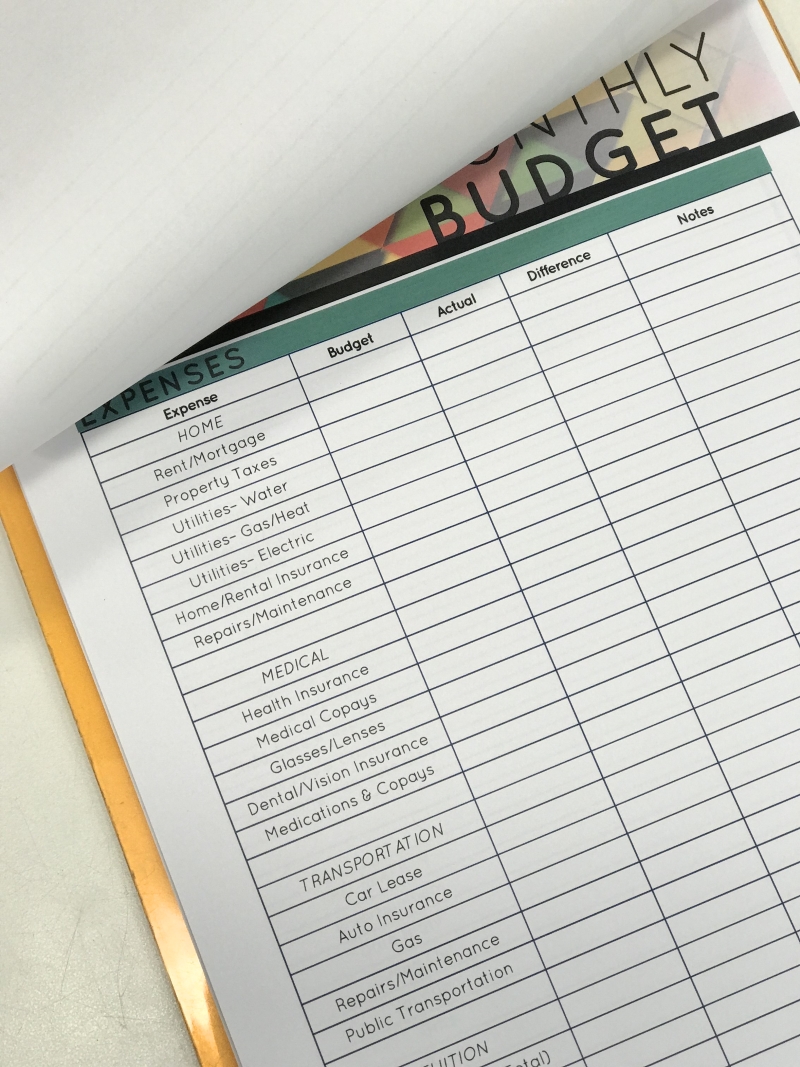

Jewish budgeting for a frum family is a little different than budgeting in the secular world. We have many more non-negotiable expenses to take into account, like the ones mentioned above, kosher food and a higher cost of living for many of us in big cities.

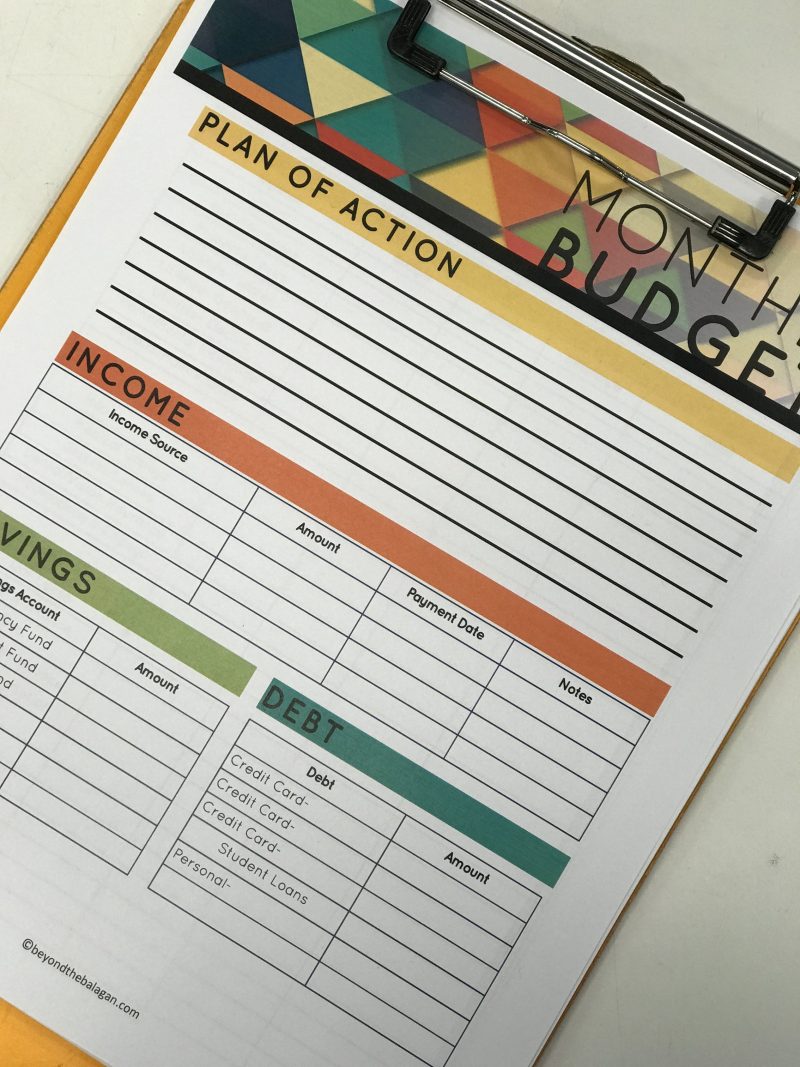

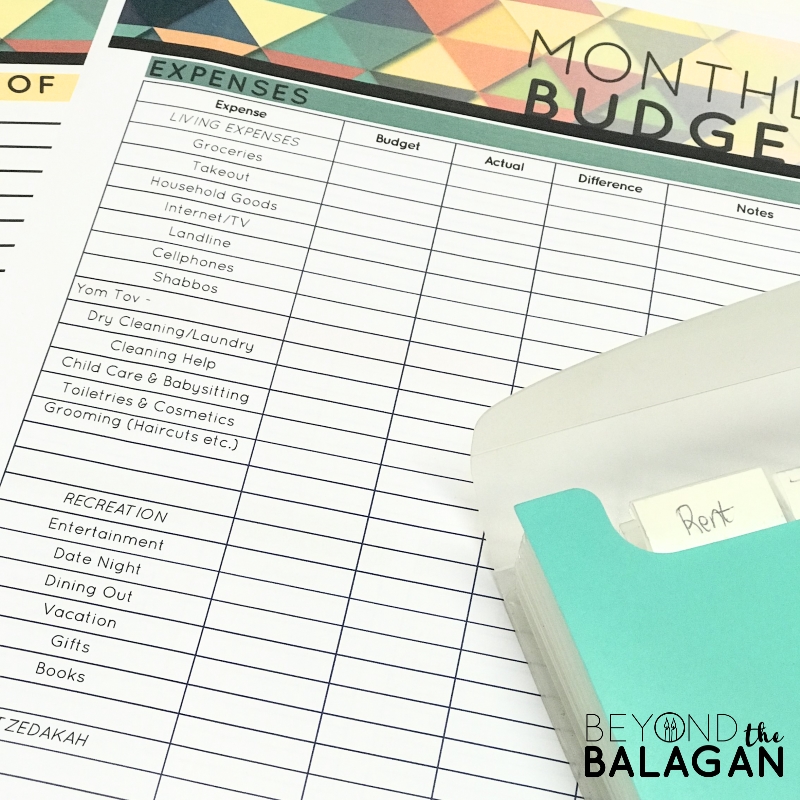

The printable, which is available for download towards the end of this post, actually comes in two options- one prepared with typical “frum family” expenses and a blank version. I cannot assume I know what your finances or expenses look like, so you may want to use the filled one as inspiration to complete the blank one on your own. The filled one does come with a little extra space in each section to add something I may have neglected to include.

(For example, you may want to add something like lawn care, or garbage removal or a second mortgage in the “Home” category. If it applies to you, you may need to add a “Legal” section for alimony, child support or legal fees, or a “Pets” section, for pet food, kennels, vet bills and so on and so forth. You may also choose to remove a category entirely if it doesn’t apply to your situation, like “Tuition”.)

Jewish budgeting: 5 tips to start from scratch

1. Make it tangible

I’m the kind of person that needs to see and feel in order to process information. So, one of the best things I did while tracking my spending was turning everything into cash. (If I recall correctly, this idea was gleaned from Dave Ramsey.)

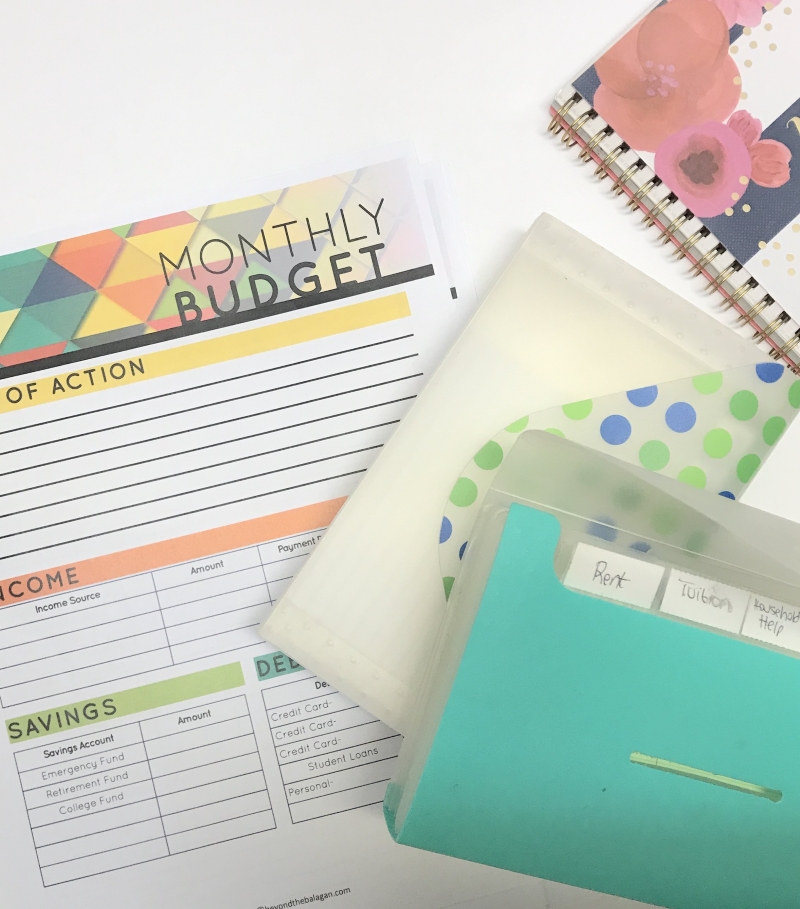

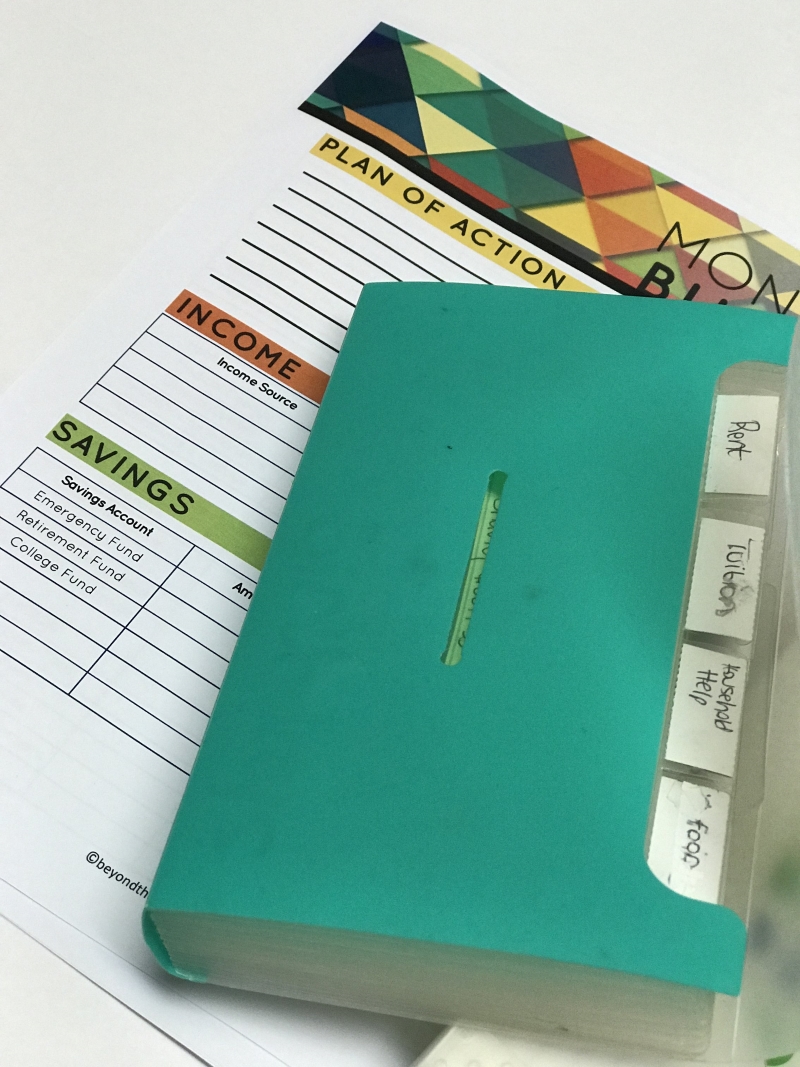

I cashed every check, bought these handy little accordion folders, and divided the cash into different categories. I stuck an index card into each section with notes- how much I put in to begin with, how much I spent and so on. Any receipts, I put into the same category.

I actually bought two of the folders- one to carry with me daily in my pocketbook for living expenses, and one I kept at home that accrued things like rent and tuition, which were only billed monthly.

This really helped me see my cash flow and spending. We don’t use credit cards, so this was very doable for us. It also helped reinforce our rule- if we don’t have the money, we don’t buy it.

2. Be on the same page

It is imperative that you and your partner be on the same page when it comes to finances.This may seem obvious, but unfortunately, many people struggle with this. In every relationship, you’ll have one partner who is a spender and one who likes to save. But dealing with major financial decisions, and knowing how to not spend when money is tight is something you must be able to communicate about.

If you and your spouse struggle with this, it may helpful to sit down with a third party, be it a therapist, or financial adviser, and gain some clarity. Communication (or miscommunication) regarding finances can be stressful, and can lead not only to a strain on your budget, but also on your marriage.

3. Don’t forget to re-evaluate

If you’re just starting to create a budget for your family, tracking your spending is a great place to start. However, in a few months’ time, or a year, or a life event can cause your budget to change. Don’t forget to go over your budget every month to ensure that you are spending correctly, or taking active steps to live within your means.

4. Be honest

Ask yourself this: are you really, truly living within your means? If your expenses are greater than your income, carefully examine your spreadsheet and see where you can cut down. Can you cut meat during the week? Can you make DIY homemade gifts instead of buying?

5. Find what works for you

Number one on this list is something that worked well for my family, but it might not work well for you at all. Figure out what will. There are so many ways to track your spending, be it via Excel spreadsheet, or an app, or Mint.com, or by downloading the printable in this post. The important thing is for you to start somewhere.

Download your Jewish Budgeting template

[show_boutique_widget id=”677509″]